During the past 10 years, countries have issued debt at outrageously low interests. This has made states lazy, overconfident on debt to finance conventional payments. Now, default risks are going up all over the board and financing is more expensive.

States, especially Western ones, who have become dependent on debt, now see how there is no other possible income source to finance the way out of the crisis, and expenses keep piling up. Once they relied on debt, they have taken care of a lot of redundant and questionable expenses that are now in the same bag as the functional and basic operational expenses that account for the services the state has to give its citizens. However, this bag is like a pudding, everything is mixed. Every budgetary expense is going to raise turmoil if cut, since there will always be a mouth fed by some dysfunctional social policy, somebody used to cheap subsidies, addicted to some outrageous political promise.

I attended an occupy meeting in an unknown European city attended by unlikely members. They were unemployed, and apparently had suffer from a poor education. A school teacher who was sacked claimed the government was on strike because it has stopped "feeding the citizens" with rights. Absolutely dumb! They even went into raising funds for something that apparently happened in Peru (???) !!! I was outraged. In which world did those people live? Of course, they had their iPhones.

People has lost the contact with reality, if they ever had any. People should learn to pay whatever services they want with their taxes, not by selling debt and promise to pay it in the future. To raise taxes one needs industry, and people should learn that they lost every bit of manufacturing to China, where their iPhone comes from, where they earn a slave salary, the salary that their will converge to. People should learn that the State cannot make up to the industry loss. A job made to fulfill a new law does not compensate a manufacturing job lost to cheaper hands. The state needs to pay for that and it can only be done with new debt issues.

So, next time you meet some gimme-right character, you tell him to

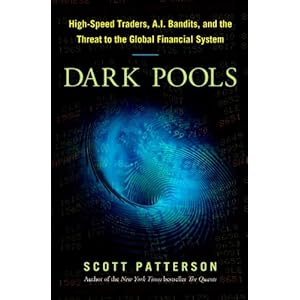

SHUT HIS MOUTH AND FUCKING READ SOMETHING IMPORTANT

Ohh by the way, screw the the clown game called olympic games (intentional lower-case).

RTX: Record Backlogs And Structural Demand Signal Upside

13 minutes ago