I recently saw much evidence of this in the latest Spanish demonstrations asking to surround the Parliament. There is a law in Spain that makes it mandatory for police officers to clearly display their ID when they are working. Well, the Government issued a order for them to hide it in these demonstrations. There are two orwelian laws that they are about to pass:

- It will be banned to film police officers in the course of their work, which includes demonstrations.

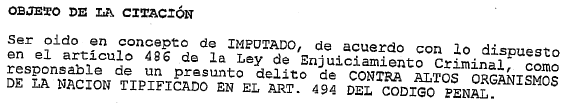

- Publicly insulting or harming a government official will be punishable by jail and by the State taking over private assets.

So there you have it, we have mindless people who can't make the simplest plan and they have to circumvent law, or evoke "the common good" to steal from somebody, instead of registering the domain before releasing the name to the public.

This attacks on the law are not free. They constitute a toll to high to bear for a civilized country. This state of lawless, or alegality, of legal insecurity, harms businesses and trade, and brings poverty.

Meanwhile, Spanish people are still distracted, they still buy the congenial optimism their politicians sell them, the little drop of subjective hope that their brains need to go on and prevents them from picking up a shovel and hit some politician on the head, which is what they a really need. The ad, depicting the usual suspects of the poorly artistic TV soaps, realities and the rest of wave-populating garbage, have them recite some puny facts which are supposed to be a basis of pride for a Spaniard, such as 7 Nobel laureates (!!), 1st place in organ donation (!!) and a lot of airports (like Ciudad Real and Castellon, which host no flights and had to be closed, not even Ryanair wanted to leave their passengers in the middle of nothing, just for the glory of the politicians and constructors, who took public money to build something nobody needed and nobody wanted).

The internet boards are full of supporters of this ad. They claim they need fresh air in the middle of all this negativity. This class of optimism doesn't help. This promotes inmovilism, invokes national pride on a bunch of facts that either have nothing to do with the situation or are a direct cause of it, like the construction of useless airports with the money of everybody. But if you tell them this ad is following a dictatorial guideline to prevent the masses from acting, you will be confronted. The human brain is like that, and mass sentiment scales it. You cannot have a negative mass sentiment, people would suicide, you can only have positive mass sentiments, such as what this evokes, or Hitler filling Nurenberg. This is a direct consequence of societal evolution. Society has evolved a lot in 5000 years, but the human brain is essentially the same. They react to somebody shooting, but they can't react the same way to somebody stealing billions, even though the consequences are far more reaching.